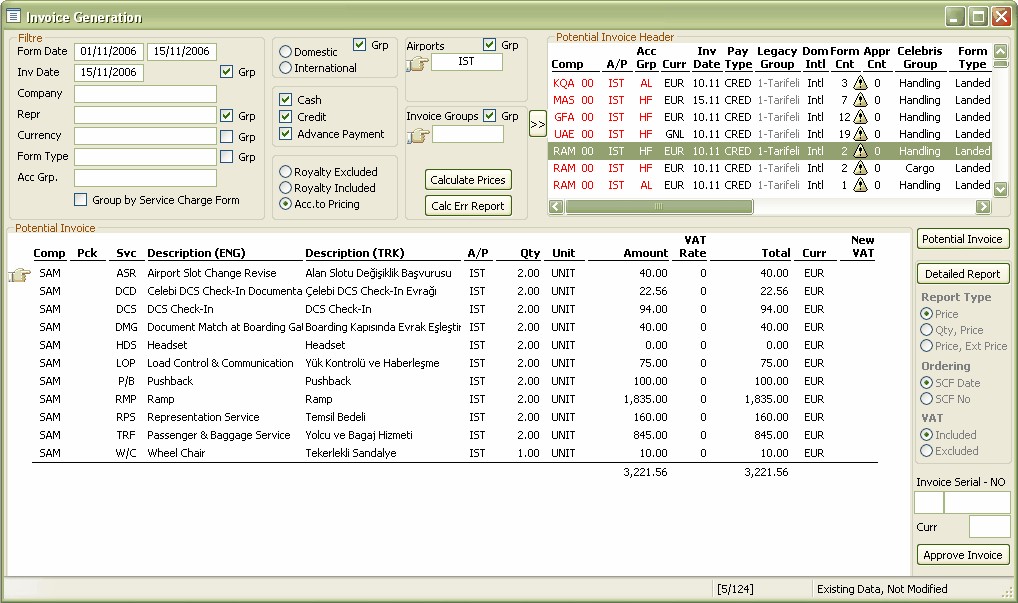

The potential invoice headers are produced with the help of the Invoice Generation Filter. The potential invoice headers are naturally produced from the service forms that are not invoiced yet and are within the requested invoice generation filter. Consider the following screenshot:

After entering appropriate values to the invoice generation filter, ![]() button is pressed to get the potential invoice headers report. In the potential invoice headers area, the company code, representative code (00 for no representative), airport, 3rd party accounting integration user defined accounting group, currency, invoice date, payment type (can be cash, credit and advance payment), legacy group (handling company defined group), domestic/international, service form count, approved service form count, Celebris group (invoice group), form type, description, minimum and maximum service charge form code numbers are reported.

button is pressed to get the potential invoice headers report. In the potential invoice headers area, the company code, representative code (00 for no representative), airport, 3rd party accounting integration user defined accounting group, currency, invoice date, payment type (can be cash, credit and advance payment), legacy group (handling company defined group), domestic/international, service form count, approved service form count, Celebris group (invoice group), form type, description, minimum and maximum service charge form code numbers are reported.

If the service form count and approved service form count is not the same, an ![]() icon is displayed in between these two fields. Normally, invoices are created from the approved service forms. In Celebris there is a service form control mechanism that aims the service forms to be controlled by a more authorized operations employee (than the service form responsible employee). It is also possible to generate invoices from non-approved service forms but this action requires an additional role, the accounting admin role.

icon is displayed in between these two fields. Normally, invoices are created from the approved service forms. In Celebris there is a service form control mechanism that aims the service forms to be controlled by a more authorized operations employee (than the service form responsible employee). It is also possible to generate invoices from non-approved service forms but this action requires an additional role, the accounting admin role.

Right clicking on the potential invoice header brings out a context sensitive menu.

Using this menu, the accountant can show the potential invoice on the bottom of the screen, request a detailed report (both actions also doable using the command buttons on the screen) and request a form control and approval mail to be sent to the responsible employees.