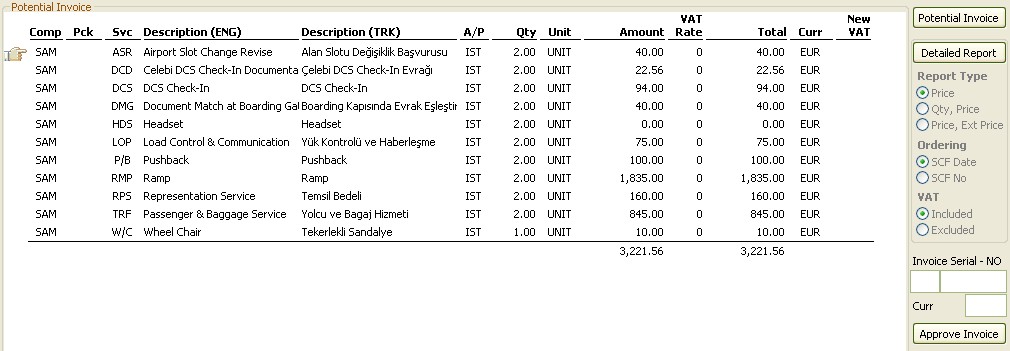

The potential invoice area shows what could the invoice be like if this potential invoice is approved.

There are certain actions that can be done before approving this invoice. One of the actions is change the vat rate for a service. Although the VAT rates are predefined and calculated accordingly by Celebris, it is possible to override the vat rate here. In order to override a vat rate, a new percent value could be entered in the new vat section of the service line and then the potential invoice button can be pressed again.

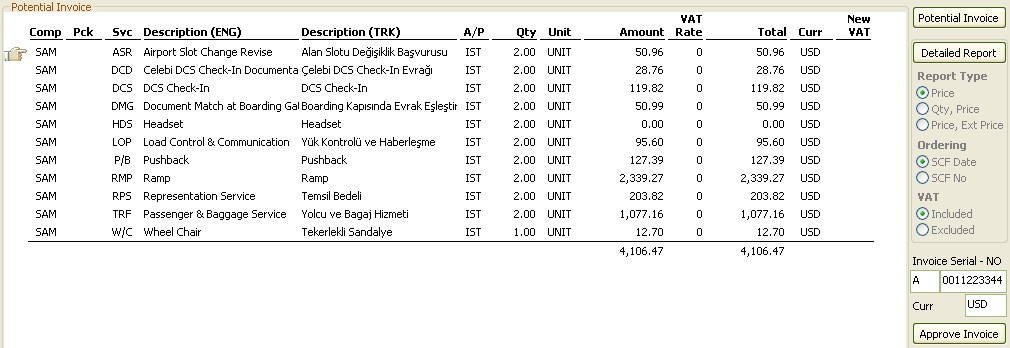

Another action that can be done is to change the currency of the potential invoice. The invoice currency is determined by Celebris using the initial agreements for the requested company. However, there can be times, when there is a need of approving an invoice in a different currency. To do that, the Curr element in the right-down side of the screen is provided with the new currency value and then the potential invoice button can be pressed again. Consider the following screenshot for the same potential invoice after the invoice currency is changed to USD from EUR:

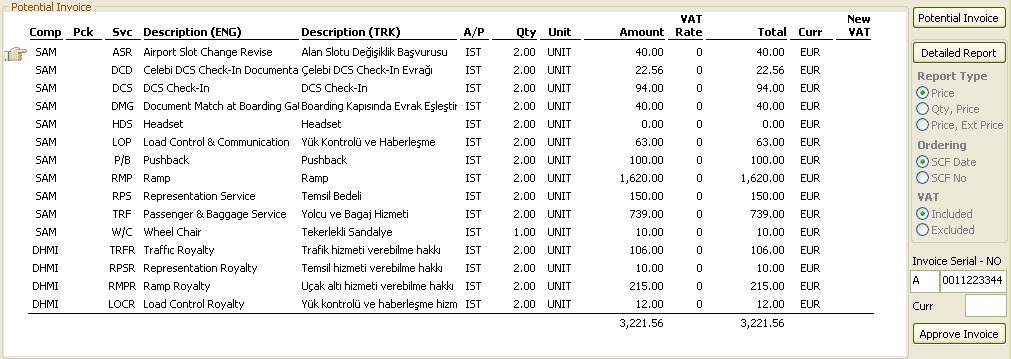

Also, it would be possible to change the look of this invoice before approving. On the top of the potential invoice area there are three different formats that can be chosen:

![]()

Let us consider the following royalty excluded format in the default EUR currency:

As you can see, the accountant has all the tools and flexibility before finalizing an invoice. Celebris pre calculates every detail as indicated in the agreements. But it then gives flexibility to the user to change just anything before finalizing the invoice. The invoice generation part is one of the best loved parts of Celebris as a result of this great flexibility.